We can’t thank Tim Britt enough for his regular guest posts on our blog and for regularly educating our clients about their mortgage questions! We don’t exchange any compensation with Tim when our clients obtain a mortgage from him, but we do share his passion for educating and serving our clients through every step of the real estate transaction! If you enjoy this post or want to learn more about Nashville housing and mortgage news, subscribe to our monthly newsletter here for future updates or just reach out to one of us directly! All of our contact info is at the bottom of this post and in the website footer below. We’re always excited to hear from our blog and newsletter readers!

In March, I wrote that a mortgage is kind of like a 3-legged stool; there are three components that must be analyzed for their capacity to help an applicant qualify for (or support) a particular mortgage loan program. Think of the abbreviation “CIA.” (hint – not the spy agency!)

This month (and next), we’re going to focus on the Credit “leg” of the stool!

A key element of the pre-qualification and loan approval process is a thorough review of a prospective buyer’s credit history. There are 2 separate, but equally important elements to the credit history: the numerical score, and the historical usage of credit. While time and space don’t permit an in-depth discussion, I want to talk mainly about the Credit Score this month.

A credit score is a statistical means of determining how likely a borrower is to default on a mortgage, based on their credit history compared to the model.

Most residential mortgage lenders use a scoring model created by the FICO Company, specifically designed for our industry. This scoring system yields a number ranging from 300 to 850. FICO has 9 different scoring models that are used by various financial sectors. This, along with the fact that there are many other scoring models available for both commercial and consumer use (Beacon, Empirica, Vantage, Credit Karma, Credit Sesame, etc.), explains the confusion many folks have when they believe their credit score to be at one level, but their mortgage score is quite different!. While I can’t speak to how the other models arrive at their numerical score, I can offer some insight on how a mortgage credit score is derived.

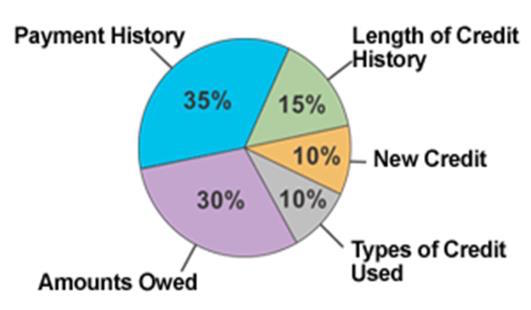

Revolving charge history and usage is the single-most prevalent component in a mortgage credit score…comprising over 65% of the weight in the scoring model. Historically, consumers who use revolving credit responsibly have a lower mortgage default rate. The logic goes like this: revolving charge account balances and monthly payments can vary from month-to-month (vs. an installment loan with a fixed payment).

When a consumer shows the ability over time to manage a variable payment situation responsibly, history shows them to be a lower default risk. The 2 major factors considered on revolving charge history are the utilization (current balance vs limit) and payment history. If a consumer has a few open charge accounts, where the balances are 30% or less of the limit, and no late payments within the last 36 months, their scores (all other factors notwithstanding) have the opportunity to be closer to the top of the range.

Other factors considered in computing the numerical score are:

- Types of credit accounts

- # of inquiries in the last 120 days

- # of accounts with balances

- Derogatory events (bankruptcy, judgements, etc.)

- Length of time accounts have been open

- Collection accounts

When a lender “pulls” your credit report, it’s considered to be a “hard” inquiry and will reduce your overall score by roughly 3 points in most cases. Keep in mind, however, that when you’re shopping for a home mortgage (or an auto loan), you have a 30-45 day “grace period” from that initial inquiry where you can have other lenders pull your credit with no additional impact to your score. This gives you the opportunity to shop for the lender who will provide the best service for your individual desires and needs, without worrying about the effect on your credit score.

The score is only half the story! Next month, we’ll talk about other items on a credit report that may impact a homebuyer’s ability to qualify for the best home loan program, as well as some suggestion for improving your score if it’s not exactly where you’d like it to be!

(Update: For part 2 of this series, click here.)

Tim Britt is a Senior Mortgage Loan Officer (NMLS 1369718) with Fifth Third Bank in Brentwood, TN. He can be reached at 615-415-8887 or [email protected].

window.dojoRequire([“mojo/signup-forms/Loader”], function(L) { L.start({“baseUrl”:”mc.us13.list-manage.com”,”uuid”:”b3560441a030ec3ce9b8bfb77″,”lid”:”4f35c52094″,”uniqueMethods”:true}) })