If you’re planning to buy a home, it’s critical to understand the relationship between mortgage rates and your purchasing power. Purchasing power is the amount of home you can afford to buy that’s within your financial reach. Mortgage rates directly impact the monthly payment you’ll have on the home you purchase. So, when rates rise, so does the monthly payment you’re able to lock in on your home loan. In a rising-rate environment like we’re in today, that could limit your future purchasing power.

Today, the average 30-year fixed mortgage rate is above 5%, and in the near term, experts say that’ll likely go up in the months ahead. You have the opportunity to get ahead of that increase if you buy now before that impacts your purchasing power.

Mortgage Rates Play a Large Role in Your Home Search

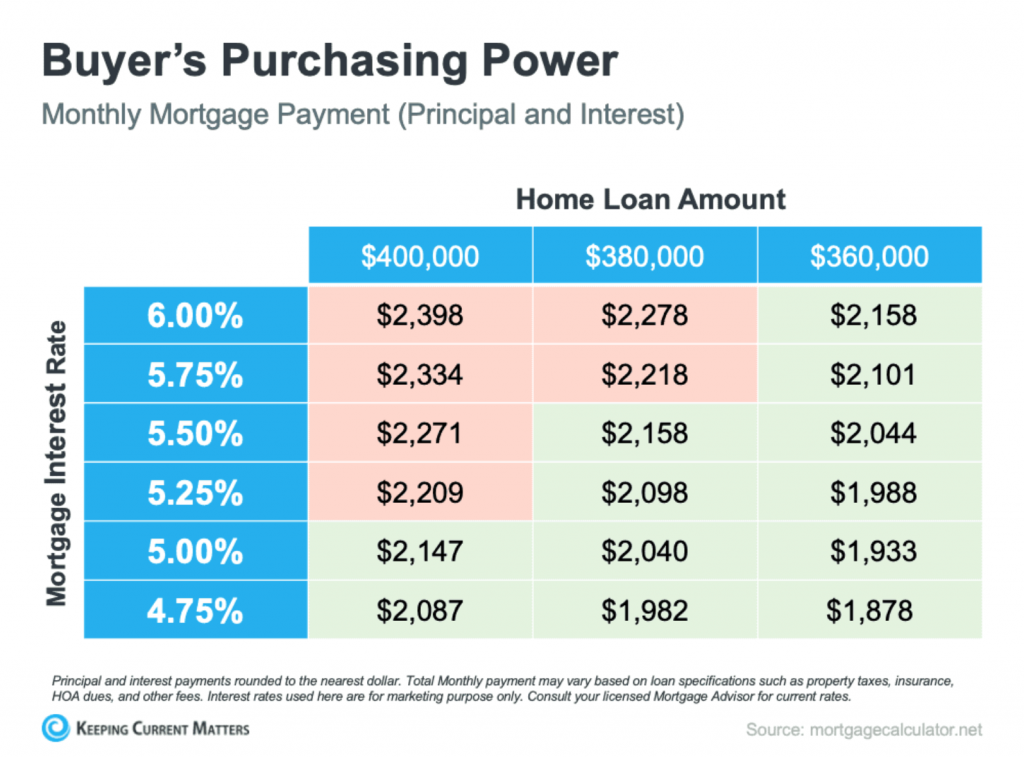

The chart below can help you understand the general relationship between mortgage rates and a typical monthly mortgage payment within a range of loan amounts. Let’s say your budget allows for a monthly mortgage payment in the $2,100-$2,200 range. The green in the chart indicates a payment within that range, while the red is a payment that exceeds it (see chart below):

As the chart shows, you’re more likely to exceed your target payment range as mortgage rates increase unless you pursue a lower home loan amount. If you’re ready to buy a home, use this as your motivation to purchase now so you can get ahead of rising rates before you have to make the decision to decrease what you borrow in order to stay comfortably within your budget.

Work with Trusted Advisors To Know Your Budget and Make a Plan

It’s critical to keep your budget top of mind as you’re searching for a home. Danielle Hale, Chief Economist at realtor.com, puts it best, advising that buyers should:

“Get preapproved with where rates are today, but also consider what would happen if rates were to go up, say another quarter of a point, . . . Know what that would do to your monthly costs and how comfortable you are with that, so that if rates do move higher, you already know how you need to adjust in response.”

No matter what, the best strategy is to work with your real estate advisor and a trusted lender to create a plan that takes rising mortgage rates into consideration. Together, we can look at your budget based on where rates are today and craft a strategy so you’re ready to adjust as rates change.

Bottom Line

Even small increases in mortgage rates can impact your purchasing power. If you’re in the process of buying a home, it’s more important than ever to have a strong plan. Partner with Rice Miller Group and a trusted lender to strategize so you can achieve your dream of homeownership this season.