Now that the “season” for buying and selling homes is upon us, it’s imperative for prospective homebuyers to understand their financial readiness to purchase…BEFORE they go shopping!

There’s seldom a worse feeling than potential homebuyers who view several homes, fall in love with “the ONE,” only to find out that it doesn’t fit for them financially. Requests for Pre-Qualification are starting to increase…and I often get asked: “what’s the difference between Pre-Qualification, and Pre-Approval?”

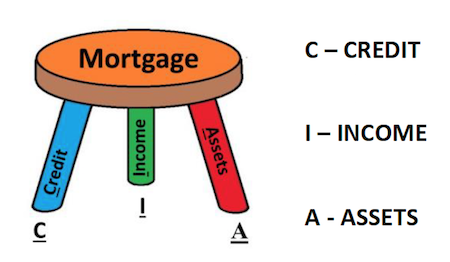

To better illustrate – keep in mind that a mortgage is kind of like a 3-legged stool; there are three components that must be analyzed for their capacity to help an applicant qualify for (or support) a particular mortgage loan program. Think of the abbreviation “CIA.” (hint – not the spy agency!)

Review and evaluation of these components comprises the mortgage qualification and approval process.

So – what’s the difference?

Pre-Qualification starts with taking a loan application from a prospective buyer and obtaining their permission to retrieve their FICO Credit report. This report is reviewed for the numerical score(s), the historical usage of credit, and the liabilities a client may have. Next, the Income is analyzed by reviewing either recent payroll statements, W-2 forms, Tax Returns, employment history, etc. Lastly, the Assets are reviewed (bank statements, brokerage and/or retirement accounts, etc.) to ascertain the amount of funds available for the transaction vs what may be needed. Additionally, a debt-to-income ratio calculation will determine the size of the loan and monthly payment the client may qualify for.

This review is conducted by a licensed loan officer who matches the findings with various loan programs to determine which one(s) best suit their overall financial plan and needs for home ownership. The information is then input into an Automated Underwriting System, which compares the data on the loan application to the specific agency’s (e.g. FNMA, VA, FHA) lending guidelines for compliance, as well as financial soundness. With positive findings, the client can then be “Pre-Qualified.”

Pre-Approval takes the above review, and adds additional “human” review element(s). The word “Approval” in mortgage lending connotes that all information on the application and required documentation has been physically verified, and that a licensed Underwriter has confirmed it meets the lending guidelines of the loan program the client is applying for. The actual term used is “Conditional Approval,” meaning that the loan application meets the guidelines, and can be approved and funded after certain minor “conditions” are satisfied. Most applications do not go through the “human” Underwriting process until a Purchase and Sale Agreement has been bound…however, there are certain occasions where advance Underwriting may be prudent prior to an offer for purchase.

Although the terms (Qualification and Approval) often get innocently interchanged in our conversations with Realtors and clients, it’s more important to understand the process that a lender uses to pre-qualify clients.

Processes may vary between different lending institutions. The above description is the process that we use…primarily because when we issue a pre-qualification letter, we want all parties (Listing Agent, Buyer’s Representative, and client) to be confident that financing will be approved for the purchase. A thorough review of the 3 “legs of the stool” will provide everyone with the assurance that the mortgage process will proceed smoothly, and the loan will close and fund on time!

Tim Britt is a Senior Mortgage Loan Officer (NMLS 1369718) with Supreme Lending in Franklin, TN, and is licensed to originate mortgages in TN, AL, KY and MI. He can be reached at 615-415-8887 or [email protected]. You can apply for a mortgage online at timbritt.supremelending.com.

window.dojoRequire([“mojo/signup-forms/Loader”], function(L) { L.start({“baseUrl”:”mc.us13.list-manage.com”,”uuid”:”b3560441a030ec3ce9b8bfb77″,”lid”:”4f35c52094″,”uniqueMethods”:true}) })